Wildlife means all the flora and fauna, which are not domesticated by humans. It includes animals, birds,plants,insects and microorganisms.

With large regional variations in physiographic,climate,and edaphic types, indian forests offer a large variety of wild life in india.India bosts of more than 90,000species of animals which is about 6.5% of the world’s total species.Indian fauna includes about 6,500 invertebrates, 5,000mollusc,2,546 species of fishes, 2,000 species of birds,458 species of reptiles,4 species of panthers and over 60,000 species of insects.

The wildlife in India comprises a mix of species of different types of organisms. Apart from a handful of the major farm animals such as cows, buffaloes, goats, poultry, and camels, India has an amazingly wide variety of animals native to the country. It is home to Bengal and Indochinese tigers, Indian lions, deer, pythons, wolves, foxes, bears, crocodiles, wild dogs, monkeys, snakes, antelope species, varieties of bison and the Asian elephant. The region’s rich and diverse wildlife is preserved in 120+ national parks, 18 Bio-reserves and 500+ wildlife sanctuaries across the country. India has some of the most biodiverse regions of the world and hosts four of the world’s 35 biodiversity hotspots – or treasure-houses – that is the Western Ghats, the Eastern Himalayas, Indo-Burma and Nicobar islands in Sundaland. Since India is home to a number of rare and threatened animal species, wildlife management in the country is essential to preserve these species. India is one of the seventeen megadiverse countries. According to one study, India along with other 16 mega diverse countries is home to about 60-70% of the world’s biodiversity.India, lying within the Indomalaya ecozone, is home to about 7.6% of all mammalian, 12.6% of avian, 6.2% of reptilian, and 6.0% of flowering plant species.

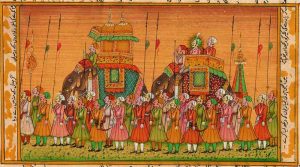

India has the largest population of elephants.Many Indian species are descendants of taxa originating in Gondwana, to which India originally belonged. Peninsular India‘s subsequent movement towards, and collision with, the Laurasian landmass set off a mass exchange of species. However, volcanism and climatic change 20 million years ago caused the extinction of many endemic Indian forms. Soon thereafter, mammals entered India from Asia through two zoogeographical passes on either side of the emerging Himalaya. As a result, among Indian species, only 12.6% of mammals and 4.5% of birds are endemic, contrasting with 45.8% of reptiles and 55.8% of amphibians. Notable endemics are the Nilgiri leaf monkey and the brown and carmine Beddome’s toad of the Western Ghats. India contains 172, or 2.9%, of IUCN-designated threatened species.These include the Asian elephant, the Asiatic lion, Bengal tiger, Indian rhinoceros, mugger crocodile, and Indian white-rumped vulture, which suffered a near-extinction from ingesting the carrion of diclofenac-treated cattle.

In recent decades, human encroachment has posed a threat to India’s wildlife; in response, the system of national parks and protected areas, first established in 1935, was substantially expanded. In 1972, India enacted the Wildlife Protection Act and Project Tiger to safeguard crucial habitat; further federal protections were promulgated in the 1980s. Along with over 515 wildlife sanctuaries, India now hosts 18 biosphere reserves, 10 of which are part of the World Network of Biosphere Reserves; 26 wetlands are registered under the Ramsar Convention.

.

Fauna

The Hanuman langur with newborn. At least seven species of grey langurs are found in India out of which five are endemic.

One of the world’s rarest monkeys, Gee’s golden langur typifies the precarious survival of much of India’s mega fauna.

The Indian rhinoceros in the Kaziranga National Park. Kaziranga in Assam, India is home to two-thirds of the one-horned rhinoceros population.

India is home to several well-known large mammals, including the Asian elephant, Bengal and Indochinese tigers,[2][3] Asiatic lion, Indian leopard,[4] Indian sloth bear and Indian rhinoceros. Some other well-known large Indian mammals are: ungulates such as the rare wild Asian water buffalo, common domestic Asian water buffalo, gail, gaur, and several species of deer and antelope. Some members of the dog family, such as the Indian wolf, Bengal fox and golden jackal, and the dhole or wild dogs are also widely distributed. However, the dhole, also known as the whistling hunter, is the most endangered top Indian carnivore, and the Himalayan wolf is now a critically endangered species endemic to India.[citation needed] It is also home to the striped hyena, macaques, langur and mongoose species.

Main fauna and their distribution area:

| Fauna name | Distribution area and discription |

| Elephant | Assam ,West Bengal,CentralIndia,three southern states(Kerela,Karnataka,Tamilnadu) |

| Rhinoceros | throughout the INDO- GANGETIC plain as far west as rajasthan.The number of this Mammal has drastically decreased and now there are less than 1500 rhino which are confined to Assam and West bengal.They survive under strict protection in the kaziranga and manassancturies of Assam and andjaldapara sanctuary of west bengal. |

| Tiger | There are 1700 tigers in india mainly found in the forests of eastern himalayan foothills and in the parts of peninsular india. |

| Cheetah | The number of cheetahs has fallen to less than 200 untill successful breeding programme in the gir sanctuary in gujrat resulted in some recovery. |

| The gaur or indian bison | It is one of the largest existing bovine and is found in the forest of central india. |

| Chinkara/the black buck/the indian gazelle/nilgai/ | The indian antelope or the blue bull |

| reptiles | Large variety of reptiles is found in india.many of them are now endangerd.there are more than 200 species or subspecies of snakes ,the best is cobra,krait,andrusselviper.these are poisonous snakes while DHAMAN is non poisonous snakes. Gharialare large size important reptiles,and there number has drastically reduced.they are hunted for their skins. The big estuarin crocodile is still found fron the ganga to the Mahanadi. The lizards include well known chameleon and the monitor lizard or varanus.they both are found in deserts and both are endangered species. Olive ridley turtle found mainly in Odisha. |

| Deer | Stag or barasingha is found in Assam,chattisgarh,madhyapradesh. The kasturimrug or musk deer lives in birch woods in the higher forests of the himalayan Thamin is a pretty deer found in manipurcontaining kasturi, |

Flora

There are about 17500 taxa of flowering plants from India. The Indian Forest Act, 1927 helped to improve protection of the natural habitat. Many ecoregions, such as the sholaforests, also exhibit extremely high rates of endemism; overall, 33% of Indian plant species are endemic.

India’s forest cover ranges from the tropical rainforest of the Andaman Islands, Western Ghats, and Northeast India to the coniferous forest of the Himalaya. Between these extremes lie the sal-dominated moist deciduous forest of eastern India; teak-dominated dry deciduous forest of central and southern India; and the babul-dominated thorn forest of the central Deccan and western Gangeticplain. Important Indian trees include the medicinal neem, widely used in rural Indian herbal remedies.

Wildlife Conservation in India

Wildlife means all the flora and fauna, which are not domesticated by humans. It includes animals, plants and microorganisms.

The need for conservation of wildlife in India is often questioned because of the apparently incorrect priority in the face of direct poverty of the people. However,

Article 48 of the Constitution of India specifies that, “The state shall endeavor to protect and improve the environment and to safeguard the forests and wildlife of the country” and

Article 51-A states that “it shall be the duty of every citizen of India to protect and improve the natural environment including forests, lakes, rivers, and wildlife and to have compassion for living creatures.”

The committee in the Indian Board for Wildlife, in their report, defines wildlife as “the entire natural uncultivated flora and fauna of the country” while

the Wildlife (protection) Act 1972 defines it as “any animal, bees, butterflies, crustacea, fish, moths and aquatic or land vegetation which forms part of any habitat.”

Despite the various environmental issues faced, the country still has a rich and varied wildlife compared to Europe. Large and charismatic mammals are important for wildlife tourism in India, and several national parks and wildlife sanctuaries cater to these needs.

Project Tiger, started in 1972, is a major effort to conserve the tiger and its habitats. At the turn of the 20th century, one estimate of the tiger population in India placed the figure at 40,000, yet an Indian tiger census conducted in 2008 revealed the existence of only 1,411 tigers. 2010 tiger census revealed that there are 1700 tigers left in India. As per the latest tiger census (2015), there are around 2226 tigers in India. By far, there is an overall 30% increase in tiger population. Various pressures in the later part of the 20th century led to the progressive decline of wilderness resulting in the disturbance of viable tiger habitats.

At the International Union for the Conservation of Nature and Natural Resources (IUCN) General Assembly meeting in Delhi in 1969, serious concern was voiced about the threat to several species of wildlife and the shrinkage of wilderness in India.

In 1970, a national ban on tiger hunting was imposed, and in 1972 the Wildlife Protection Act came into force. The framework was then set up to formulate a project for tiger conservation with an ecological approach. However, there is not much optimism about this framework’s ability to save the peacock, which is the national bird of India. George Schaller wrote about tiger conservation:

Wildlife Conservation in India: Steps taken for Wildlife Conservation In India

Like forests, wildlife is also a national resource which not only helps in maintaining the ecological balance but is also beneficial from economic, recreational and aesthetic points of view.

There was a time when human interference was minimum, the number of wild animals was quite high and there was no problem of their protection or conservation.

But, with the expansion of agriculture, settlement, industrial and other developmental activities and mainly due to greed of man the number of wild animals gradually became lesser and lesser.

As a result that several species of animals have been pronounced extinct and several others are at the verge of it. Deforestation is also one of the main reasons for the loss of wildlife. Mass scale killings of wild animals for their meat, bones, fur, teeth, hair, skin, etc., are going on throughout the world. Therefore, the need for wildlife conservation has now become a necessity.

Population growth, the expansion of agriculture and livestock raising, the building of cities and roads, and pollution are among the many pressures on the natural habitat of wildlife. Along with illegal hunting, habitat reduction and its degradation has threatened the bio-diversity of the regions where these are rampant.

Preservation of wildlife does not mean a blanket protection to all faunal and floral species; rather it implies a proper, judicious control over the multiplication of plants and animals which interact together to provide a proper environment to man whose very existence is in peril today.

Due to the irrational use of natural and biotic resources of the earth in the past, most of the wildlife has been destroyed beyond retrieval. It is our urgent duty to protect the natural splendour of ecosystems and to evolve a system of co-existence with every living creature upon the earth.

Although countries of the world are very particular regarding conservation of wildlife, the number of wild animals is reducing day by day. World Wild Life Fund is the international agency doing commendable work in promoting the protection of wildlife. There are national agencies also engaged in conservation of wildlife.

Some steps in the direction of wildlife conservation that can be taken are as follows:

(i) To survey and collect all the information about wildlife, especially, their number and growth.

(ii) To protect habitat by protecting forests.

(iii) To delimit the areas of their natural habitat.

(iv) To protect wildlife from pollution and from natural hazards.

(v) To impose complete restriction on hunting and capturing of wildlife.

(vi) To impose restrictions on export and import of wildlife products and severe punishment to be given to those who indulge in this activity.

(vii) To develop game sanctuaries for specific wild animals or for general wildlife.

(viii) To make special arrangements to protect those species whose number is very limited.

(ix) To develop general awareness at national and international level regarding protection of wildlife.

(x) A system of wildlife management is adopted through trained personnel. India is a good example where several steps have been taken for wildlife conservation. It is a country of varied wildlife, where more than 500 types of wild animals, 2,100 types of birds and about 20,000 types of reptiles and fishes have been found.

According to an estimate, in India about 200 species of wild animals and birds have become extinct and another 2,500 are on the verge of extinction. Some of them are black buck, chinkara, wolf, swamp deer, nilgai, Indian gazelle, antelope, tiger, rhinoceros, gir lion, crocodile, flamingo, pelican, bustard, white crane, grey heron, mountain quail, etc.

In India, the government and NGOs are taking keen interest in protection of wildlife. The Wild Life Protection Act, 1972, has several provisions for the conservation of wildlife. As many as 165 game sanctuaries and 21 national parks have been developed to protect the natural habitat and wild animals. Apart from this, a Wild Life Conservation Week is also celebrated from 1st to 7th October every year. But still there is a long way to go in this direction.

Legal Framework for Wildlife Conservation in India.

The Government of India has introduced various types of legislation in response to the growing destruction of wildlife and forests. These are:

- The Wildlife (Protection) Act, 1972 (Last amended in 2006)

The Wildlife (Protection) Act (WLPA), 1972 is an important statute that provides a powerful legal framework for:

- Prohibition of hunting

- Protection and management of wildlife habitats

- Establishment of protected areas

- Regulation and control of trade in parts and products derived from wildlife

- Management of zoos.

The WLPA provides for several categories of Protected Areas/Reserves:

- National Parks

- Wildlife Sanctuaries

- Tiger Reserves

- Conservation Reserves

- Community Reserves

National parks and Tiger Reserves are by law more strictly protected, allowing virtually no human activity except that which is in the interest of wildlife conservation. Grazing and private tenurial rights are disallowed in National Parks but can be allowed in sanctuaries at the discretion of the Chief Wildlife Warden. The amended WLPA does not allow for any commercial exploitation of forest produce in both national parks and wildlife sanctuaries, and local communities can collect forest produce only for their bona fide needs.

No wild mammal, bird, amphibian, reptile, fish, crustacean, insects, or coelenterates listed in four Schedules of the WLPA can be hunted either within or outside protected areas. On conviction, the penalty for hunting is imprisonment for a period ranging from a minimum of three to a maximum of seven years with fines not less than 10,000 rupees.

Community reserves and conservation reserves are two new categories of protected areas that have been included under the WLPA. These two categories provide a greater role for local communities, stakeholders and civil society as well as the opportunity to protect many areas of conservation value that cannot be designated under strict categories such as wildlife sanctuaries or national parks.

The statute prohibits the destruction or diversion of wildlife and its habitat by any method unless it is for improvement or better management and this is decided by the state government in consultation with the National and State Boards for Wildlife.

The WLPA contains elaborate procedures for dealing with legal rights in proposed protected areas and acquisition of any land or interest under this law is deemed as an acquisition for a public purpose. However, with the enactment of The Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006, compliance of various provisions relating to tenurial and community rights must be ensured.

Apart from protected area establishment, other important aspects of the WLPA include procedures for the appointment of state wildlife authorities and wildlife boards, the regulation of trade in wildlife products and the prevention, detection and punishment of violations of the WLPA.

The 2006 amendment introduced a new chapter (IV B) for establishment of the National Tiger Conservation Authority and notification of Tiger Reserves (before this amendment, Tiger Reserves were not defined under the law, but were merely administrative designations to enable funding under Project Tiger).

The Wildlife Crime Control Bureau (WCCB) was constituted vide the 2006 amendment to monitor and control the illegal trade in wildlife products.

The WLPA provides for investigation and prosecution of offences in a court of law by authorized officers of the forest department and police officers.

- The Indian Forest Act (1927) and Forest Acts of State Governments

The main objective of the Indian Forest Act (1927) was to secure exclusive state control over forests to meet the demand for timber. Most of these untitled lands had traditionally belonged to the forest dwelling communities. The Act defined state ownership, regulated its use, and appropriated the power to substitute or extinguish customary rights. The Act facilitates three categories of forests, namely

- Reserved forests

- Village forests

- Protected forests

Reserved forests are the most protected within these categories. No rights can be acquired in reserved forests except by succession or under a grant or contract with the government. Felling trees, grazing cattle, removing forest products, quarrying, fishing, and hunting are punishable with a fine or imprisonment. Although the Indian Forest Act is a federal act, many states have enacted similar forest acts but with some modifications.

- The Forest Conservation Act (1980)

In order to check rapid deforestation due to forestlands being released by state governments for agriculture, industry and other development projects (allowed under the Indian Forest Act) the federal government enacted the Forest Conservation Act in 1980 with an amendment in 1988. The Act made the prior approval of the federal government necessary for de-reservation of reserved forests, logging and for use of forestland for non- forest purposes.

This powerful legislation has, to a large extent, curtailed the indiscriminate logging and release of forestland for non-forestry purposes by state governments. While the federal government imposed such strict restrictions, it did not simultaneously evolve a mechanism to compensate state governments for loss of timber logging revenues. This anomaly coupled with increasing pressure for land due to a burgeoning population has generated considerable resentment within state governments resulting in growing pressure to dilute the restrictive provisions of the Act. The Supreme Court of India has currently imposed a complete ban on the release of forestland for non-forestry activities without the prior approval of the federal government.

- The Environment (Protection) Act (1986)The Environment Protection Act is an important legislation that provides for coordination of activities of the various regulatory agencies, creation of authorities with adequate powers for environmental protection, regulation of the discharge of environmental pollutants, handling of hazardous substances, etc. The Act provided an opportunity to extend legal protection to non-forest habitats (‘Ecologically Sensitive Areas’) such as grasslands, wetlands and coastal zones.

- The Biological Diversity Act (2002)India is a party to the United Nations Convention on Biological Diversity. The provisions of the Biological Diversity Act are in addition to and not in derogation of the provisions in any other law relating to forests or wildlife.

- National Wildlife Action Plan (2002-2016)replaces the earlier Plan adopted in 1983 and was introduced in response to the need for a change in priorities given the increased commercial use of natural resources, continued growth of human and livestock populations, and changes in consumption patterns.

The Plan most closely represents an actual policy on protection of wildlife. It focuses on strengthening and enhancing the protected area network, on the conservation of Endangered wildlife and their habitats, on controlling trade in wildlife products and on research, education, and training.

The Plan endorses two new protected area categories: “conservation reserves,” referring to corridors connecting protected areas, and “community reserves”, which will allow greater participation of local communities in protected area management through traditional or cultural conservation practices. These new categories of protected areas are likely to bring in corridor areas under protection. The Plan contains various recommendations to address the needs of local communities living outside protected areas and outlines the need for voluntary relocation and rehabilitation of villages within protected areas. The Plan recognizes the need to reduce human-wildlife conflict and emphasizes the establishment of effective compensation mechanisms. It includes the restoration of degraded habitats outside protected areas as a key objective.

- National Forest Policy (1998)The National Forest Policy, 1988, (NFP) is primarily concerned with the sustainable use and conservation of forests, and further strengthens the Forest Conservation Act (1980). It marked a significant departure from earlier forest policies, which gave primacy to meeting government interests and industrial requirements for forest products at the expense of local subsistence requirements. The NFP prioritizes the maintenance of ecological balance through the conservation of biological diversity, soil and water management, increase of tree cover, efficient use of forest produce, substitution of wood, and ensuring peoples’ involvement in achieving these objectives. It also includes meeting the natural resource requirements of rural communities as a major objective. The NFP legitimizes the customary rights and concessions of communities living in and around forests, stating that the domestic requirements of the rural poor should take precedence over industrial and commercial demands for forest products.

As can be seen from this article, India has a strong set of laws, Acts and policies for the protection of forests and wildlife. It is for citizens to study these carefully and apply them appropriately while conducting conservation advocacy campaigns.

Other measures for conservation of wildlife

Conservation Centers in India

A number of Conservation Centers have been set up in India for the purpose of studying, propagating, conserving and for the betterment of the highly endangered species of wildlife, both flora and fauna. These Conservation Centers can be divided into Wildlife Reserves, Conservation Centers and Wildlife Sanctuaries.

Conservation Centers in India

- Kaziranga Conservation Center, Assam

- Royal Chitwan Park

- Royal Bardia Park

- Sultanpur Conservation Center

- Sundarbans

- Sanjay Gandhi Conservation CenterBorivli, Mumbai

- Rajaji Conservation Center

- Bharatpur Conservation Center

- Namdapha Conservation Center, Arunachal Pradesh

- Dudhwa Conservation Center, Uttar Pradesh

- Dachigam Conservation Center, Jammu & Kashmir

- Periyar Conservation Center, Kerala

- Bannerghata Conservation Center, Karnataka

- Keibul Lam Jao Conservation Center, Manipur

- Nagarhole Conservation Center, Karnataka

- Nandankanan Biological Park, Orissa

- Valley of Flowers Conservation Center, Uttar Pradesh

- Nanda Devi Conservation Center, Uttar Pradesh

Famous Wildlife Reserves in India

- Sariska Tiger Reserve, Rajasthan

- Bandipur Conservation Center, Karnataka

- Bandhavgarh Conservation Center, Madhya Pradesh

- Corbett Conservation Center, U.P

- Kanha Tiger Reserve, Madhya Pradesh

- Ranthambore Tiger Reserve, Rajasthan

- Manas Tiger Reserve, Assam

- Tadoba Tiger Reserve

- Pench Tiger Reserve

- Namdapha Tiger Reserve, Arunachal Pradesh

Other Wildlife Reserves in India

- Dudhwa Conservation Center, U.P

- Srisailam Sanctuary, Andhra Pradesh

- Pabitora Wildlife Sanctuary, Assam

- The Palamu Tiger Reserve, Bihar

- Chandka Elephant Reserve, Orissa

- Similipal Tiger Reserve, Orissa

- Palamau Tiger Reserve, Bihar

NGOs In India

The geographical diversity in India is the corollary to the biodiversity that makes it home to a huge variety of plants, land and marine animals. While the giant Himalayas in the northern part support coniferous vegetation, the eastern states experience a moist tropical climate. On the other hand large parts of western India experience hot desert climate. Surrounded on three sides by the sea, the Indian sub-continent is home to a large variety of marine life as well.

history of killing and poaching of wildlife in India is as long and as varied as its biodiversity. The predominance of princely states, an overdose of invasions and colonialism and a lack of general awareness have stripped India of much of her wealth in every sense. Much of the wealth that India was naturally endowed with has disappeared. Below is a list of the endangered species – whose existence at stake now.

In case you are wondering, let me tell you, this is just the tip of the iceberg. However, it is never too late when the security of our foundation on earth comes under the scythe. A number of NGOs have come forward to put an end to the gory business of poaching and wildlife trafficking in India. With the help of their seminars and symposia they have been successful to a large extent in drawing the administration’s attention towards this problem. Legal activism on their part has led to certain worthwhile legislation in this regard. The ban on ivory and snakeskin trade and the listing of the whale shark in the WPA schedule are some of the legal initiatives taken by the state.

Project Elephant

Project Elephant (PE) is a wildlife conservation project initiated in India in February 1992 with the aim to provide financial and technical support to major elephant bearing States in the country for protection of elephants, their habitats and corridors.

Though this centrally sponsored scheme began with a thrust on elephant conservation in the various elephant populous bio-geographical regions of the country, it expanded its view to adopt a more comprehensive approach to the subsidiary issues of human-elephant conflict and welfare of domesticated elephants.

The Project demarcated 13 States to implement its efforts to maintaining a viable Elephant population in their natural habitat. The states being:

- Andhra pradesh

- Arunachal Pradesh

- Assam

- Jharkhand

- Karnataka

- Kerala

- Meghalaya

- Nagaland

- Orissa

- Tamil Nadu

- Uttranchal

- Uttar Pradesh

- West Bengal

For a better understanding of the main activities of the Project, they are listed below:

- Ecologically restoring the existing natural habitats and migratory routes of elephants

- Developing of scientific methods for conservation of elephant habitats and viable population of Wild Asiatic elephants in India and ensuring their continuance through planned management.

- Promoting measures for mitigating man-elephant conflict in crucial habitats and as far as possible negating the undue pressures of human and domestic stock activities in crucial elephant habitats

- Ensuring strictest adherence to “No poaching” acts formulated for Wild elephants and minimizing cases of unnatural deaths of elephants due to human or other interference.

- Research on Elephant management related issues.

- Conducting Public education and awareness programmes.

- Providing for veterinary care of the wild elephants.

- Undertaking Eco-development as a major step to fortify their efforts at wildlife conservation.

Project Tiger

Launched on April 1973 Project Tiger has successfully emerged as one of the champion endeavors of Tiger conservation as formulated by a special task force set up under Wildlife Conservation Act to address the problem of dwindling Tiger population in the country.

Though the initial push for the action was constituted by the growing concern to protect the Royal Bengal Tigers, the disturbing data presented by the 1972 All India Tiger Census, which enumerated the Tiger population at an alarming 1,827 as compared to the figure of 40,000 present at the turn of 20th century called for immediate action to curb the progressive decline of wilderness resulting in the disturbance of viable tiger habitats. Thus following steps were taken:

- Thus, a national ban was imposed on Tiger Hunting in 1970

- The Wildlife Protection Act came into force in 1972

- Project Tiger was launched in 1973 and various tiger reserves were created in the country based on a ‘core-buffer’ strategy.

The management strategy of each Tiger Reserve functioned in accordance to certain core principles mentioned below:

- All forms of human exploitation and biotic disturbance to be eliminated from the core zone and any activities carried out in the buffer zone should not impeach the wildlife habitat.

- Any habitat management carried out should be subject to redressing the damage caused by human interference in order to restore the ecosystem to its original state.

- Changes in flora and fauna are to be documented for research purpose.

In the initial phase of Project Tiger only 9 Tiger Reserves were established in different States during the period of 1973-74 by the joint effort of Central and State Governments, namely:

- Manas (Assam)

- Palamau (Bihar)

- Similipal (Orissa)

- Corbett (U.P.)

- Kanha (M.P.)

- Melghat (Maharashtra)

- Bandipur (Karnataka)

- Ranthambhore (Rajasthan)

- Sunderbans (West Bengal)

At present the number has grown to 28 reserves in 2006 with a total Tiger population of over 1000 tigers from a mere 268 in 9 reserves in 1972.

Being at the apex of the food chain, a stable Tiger population assures us of an enduring eco-system, well equipped to sustain various organisms at different levels. This is exactly what Project Tiger has accomplished by achieving a substantial increase in the tiger population.

Thus, ‘Project Tiger’ basically translates into the conservation of the entire eco-system as apart from tigers, all other wild animals population have also increased in the project areas.

In the subsequent ‘Five Year Plans’, the main thrust as been given to enlarge the core and buffer zones in certain reserves, intensification of protection and eco-development in the buffer zones of existing tiger reserves and creation of additional tiger reserves and strengthening of the research activities.

Conservation History of Gir National Park

The Conservation History of Gir National Park deals with the conservation of Asiatic lions, whose population had dropped tremendously in the early 20th century. Gir National Park is a beautiful park dotted with deciduous forests, interspersed with semi-evergreen and evergreen flora, acacia, scrub jungle, grasslands and rocky hills, along with an abundance of fauna. Sprawling over an area of 1412 sq km, the park is one of the most charming National Parks in India.

The conservation history of Gir National Park takes us back to the early 1900s. At that time, the count of lions had dropped down to just 15 through slaughter for trophy hunting. When the British viceroys brought this matter to the attention of the Nawab of Junagadh, he ensured the protection of the park. Lord Curzon, especially, requested the Nawab to conserve the lions. Thus, the forest area of Gir and its lions were declared as protected by the Nawab. A ban was also imposed on the shooting of lions.

The conservation history of Gir National Park also includes other factors that make conservation of the park essential. Gir is the largest compact tract of dry deciduous forest in the semi arid western part of India. It has the maximum number of carnivores, and also has the largest population of marsh crocodiles in the country. The park provides shelter to all these forests and animals.

Non-government involvement

As major development agencies became discouraged with the public sector of environmental conservation in the late 1980s, these agencies began to lean their support towards the “private sector” or non-government organizations (NGOs).[7]In a World Bank Discussion Paper it is made apparent that “the explosive emergence of nongovernmental organizations” was widely known to government policy makers. Seeing this rise in NGO support, the U.S. Congress made amendments to the Foreign Assistance Act in 1979 and 1986 “earmarking U.S. Agency for International Development (USAID) funds for biodiversity”. From 1990 moving through recent years environmental conservation in the NGO sector has become increasingly more focused on the political and economic impact of USAID given towards the “Environment and Natural Resources”. After the terror attacks on the World Trade Centers on September 11, 2001 and the start of former President Bush’s War on Terror, maintaining and improving the quality of the environment and natural resources became a “priority” to “prevent international tensions” according to the Legislation on Foreign Relations Through 2002and section 117 of the 1961 Foreign Assistance Act. Furthermore, in 2002 U.S. Congress modified the section on endangered species of the previously amended Foreign Assistance Act.

Some of the NGOs that have played an active role in the conservation and preservation of wildlife in India are:

- TRAFFIC India fights wildlife trafficking in India

- Wildlife Trust of India have been very vocal about the Red Jungle fowl and Golden Haired Langur

- Wildlife First works for the conservation of wilslife in Karnataka

- Wildlife Protection Society of India (WPSI) collaborate with state governments to monitor illegal wildlife trade

- Greenpeace

Active non-government organizations

Many NGOs exist to actively promote, or be involved with wildlife conservation:

- The Nature Conservancyis a US charitable environmental organization that works to preserve the plants, animals, and natural communities that represent the diversity of life on Earth by protecting the lands and waters they need to survive.

- World Wide Fund for Nature(WWF) is an international non-governmental organization working on issues regarding the conservation, research and restoration of the environment, formerly named the World Wildlife Fund, which remains its official name in Canada and the United States. It is the world’s largest independent conservation organization with over 5 million supporters worldwide, working in more than 90 countries, supporting around 1300[4] conservation and environmental projects around the world. It is a charity, with approximately 60% of its funding coming from voluntary donations by private individuals. 45% of the fund’s income comes from the Netherlands, the United Kingdom and the United States.

- WildTeam

- Wildlife Conservation Society

- Audubon Society

- Traffic (conservation programme)

- Born Free Foundation

- WildEarth Guardians

separate state. Morarji Desai did not listen them and police repression resulted in death of five to eight students. It triggered massive protests across the state. Indulal Yagnik came out of his retirement from politics and founded Mahagujarat Janata Parishad to guide movement. Many protesters including Indulal Yagnik and Dinkar Mehta, Dhanvant Shroff were arrested and kept at Gaekwad Haveli in Ahmedabad for a few days and later imprisoned in Sabarmati Central Jail for three and half months. Protest also spread in other parts of the state which forced Morarji Desai to go on week-long fast. People did not turned up to support him during fast and stayed in home following self-imposed curfew, Janata Curfew. Just before the declaration of carving three states as Nehru suggested, 180 members of Parliament suggested return to bilingual Bombay state together. There was conflict over Mumbai and Dang which was solved through discussions. Gandhian activist Ghelubhai Nayak actively lobbied for accession of Dang in Gujarat. Mumbai went to Maharashtra and Dang went to Gujarat.

separate state. Morarji Desai did not listen them and police repression resulted in death of five to eight students. It triggered massive protests across the state. Indulal Yagnik came out of his retirement from politics and founded Mahagujarat Janata Parishad to guide movement. Many protesters including Indulal Yagnik and Dinkar Mehta, Dhanvant Shroff were arrested and kept at Gaekwad Haveli in Ahmedabad for a few days and later imprisoned in Sabarmati Central Jail for three and half months. Protest also spread in other parts of the state which forced Morarji Desai to go on week-long fast. People did not turned up to support him during fast and stayed in home following self-imposed curfew, Janata Curfew. Just before the declaration of carving three states as Nehru suggested, 180 members of Parliament suggested return to bilingual Bombay state together. There was conflict over Mumbai and Dang which was solved through discussions. Gandhian activist Ghelubhai Nayak actively lobbied for accession of Dang in Gujarat. Mumbai went to Maharashtra and Dang went to Gujarat.

feudalism, favouritism and archaic methods of governance. For us, governance is a mission that isn’t complete without proactive involvement of the citizens of India. It strive to provide a clean and efficient government that invites proactive participation and involvement of citizens at every step.

feudalism, favouritism and archaic methods of governance. For us, governance is a mission that isn’t complete without proactive involvement of the citizens of India. It strive to provide a clean and efficient government that invites proactive participation and involvement of citizens at every step.