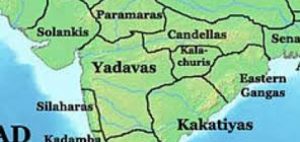

Solanki of Gujrat

The Solanki dynasty ruled parts of what are now Gujarat and Kathiawar in India between 950-1300 CE. The kings of the dynasty used the self-designation Chaulukya, and are also known as the Chalukyas of Gujarat or as the Solanki Rajputs. The dynasty ended when Alauddin Khalji conquered Gujarat. Gujarat was a major centre of Indian Ocean trade, and their capital at Anhilwara (modern Patan, Gujarat) was one of the largest cities in India, with population estimated at 100,000 in 1000 CE. In 1026, the temple complex of Somnath in Gujarat was destroyed by Mahmud of Ghazni. After 1243, the Solankis lost control of Gujarat to their feudatories, of whom the Vaghela dynasty of Dholka came to dominate. After 1292, the Vaghelas became tributaries of the Seuna (Yadava) dynasty of Devagiri in the Deccan Plateau.

The Solankis were usually referred to as the “Chalukyas of Gujarat” by their contemporaries. The vast majority of their own records describe them as “Chaulukya”, which is thought to be a variant of “Chalukya”. There are several other dynasties with this name: the Chalukyas of Badami, the Chalukyas of Kalyani, the Chalukyas of Vengi and the Chalukyas of Lata. The various dynasties using this name are sometimes thought to be branches of the same family, but the relationship between all of them is not certain. Unlike the Chalukyas of Kalyani and Vengi, the Solankis never claimed a shared descent or any other association with the original Chalukya dynasty — the Chalukyas of Badami. Moreover, they never used the term “Chalukya” to describe themselves, instead using its variant “Chaulukya”.

However, the Solankis did share a myth of origin with the Chalukyas of Kalyani and Vengi. According to this legend, the progenitor of the dynasty was created by Brahma. The version of the legend mentioned in the Vadnagar prashasti inscription of Kumarapala is as follows: the deities once asked the creator god Brahma to protect them from the danavas (demons). Brahma then created a hero from his chuluka (pot or folded palm), which was filled with Ganges water. This hero was named Chulukya, and became the progenitor of the dynasty. A variation of this legend is mentioned by Abhayatilaka Gani in his commentary on Hemachandra’s Dvyashraya-Kavya. According to this version, Brahma produced the hero to support the earth, after his other creations disappointed him. These stories are of no historical value, as it was customary for contemporary royal houses to claim mythical and heroic origins. The Kumarapala-Bhupala-Charita of Jayasimha Suri presents Chulukya as a historical warrior, whose capital was Madhupadma. Mularaja was his descendant, with nearly a hundred generations separating the two.This account may be partly historical: Madhupadma has been identified variously as a location outside Gujarat, including present-day Mathura.

The Prithviraj Raso mentions the Agnikula legend, according to which some of the Rajput dynasties including the Solankis were born from a fire-pit on Mount Abu. A section of colonial-era historians interpreted this mythical account to suggest a foreign origin for these Rajputs. According to this theory, the foreign ancestors of these Rajputs came to India after the decline of the Gupta Empire around 5th century CE, and were admitted in the Hindu caste system after performing a fire ritual. Based on this legend, D. R. Bhandarkar and others theorized that the Chalukyas were a branch of Gurjaras, whom they believed to be of foreign origin. However, the Solankis’ own inscriptions do not claim an Agnikula origin for their dynasty. The Agnikula legend of origin was first used by the neighbouring Paramara dynasty The original copies of Prithviraj Raso do not mention this legend. The 16th century poets might have extended the Paramara legend to include other Rajput dynasties, in order to foster Rajput unity against Mughals. The Solanki inscriptions from the reign of Bhima II prove that the Solankis knew about the Agnikula legend, but associated it with the Paramaras, not themselves.

Solanki kings

Mularaja

Mularaja Mularaja supplanted the last Chavda king of Gujarat and founded an independent kingdom with his capital in Anahilapataka in 940-941 AD. He was a Shaiva king operating within Brahmanical and Vedic paradigms of kingship. He built Mulavasatika (Mula’s residence) temple for Digambaras and the Mulanatha-jinadeva (the Jina who is Mula’s lord) temple for the Svetambaras.

Bhima 1

Bhima I was the next important ruler after Mularaja. He built Sun Temple, of Modhera. His wife Udaymati built the Rani ki vav step-well in his memory. The guardian family deity of the Solanki was Somnath at Prabhas. It was during the Solanki’s rule that the scared shrine was sacked by Mahmud of Ghazni.

Karna

Bhima I’s successor Karna defeated a Bhil chieftain and founded Karnavati which is now known as Ahmedabad. Karna married Mayanalladevi by whom he begot Jayasimha Siddharaja.

Jayasimha Siddharaja

Jayasimha Siddharaja ruled for half a century starting in 1094 and enlarged the kingdom to become an empire. The Rudra Mahakala Temple at Siddhapur is an architectural expression of his rule. Hemachandra, a Jain monk, rose to prominence and had good relation with the king. Apart from Saurashtra and Kutch, Jaysinh also conquered Malwa. One of the favourite legends of the Gujarat bards is woven around the siege of Junagadh by Jaysinh. The fort was ultimately captured by him along with Ranakdevi, wife of the Chudasama ruler Ra Khengar. Ranakdevi preferred to commit sati rather than remarry Jaisinh and he was persuaded to allow her to burn herself on a pyre at Wadhwan. Ranakdevi Temple still stands in Wadhwan at the site of her death.

Kumarapala

Siddhraj’s successor Kumarapala’s reign lasted for 31 years from 1143 to 1174 CE. He too had good relationship with Hemchandra and he propagated Jainism during his rule in Gujarat. He rebuilt Somnath temple. During Kumarapala’s reign, Gujarat’s prosperity was at its peak.

Mularaja II

Mularaja II successfully repelled the incursions of Muhammad of Ghor who had the ambition of repeating the act performed by Mahmud of Ghazni.